No will? Then the law steps in.

Under the Hindu Succession Act, 1956, a Hindu’s property moves through a strict heir hierarchy, from Class I and II heirs to distant relatives. And if no one qualifies, the government becomes the final heir.

What if a Hindu dies without a Will? How is his/her estate distributed?

A detailed description and steps followed as per the Hindu Succession Act:

Let’s start with a simple truth most people don’t realize:

If a Hindu male passes away intestate (without a will), his property doesn’t get divided based on family discussions, emotional bonds, or who “deserves it.”

Instead, the law calmly takes charge.

Under the Hindu Succession Act, 1956, inheritance follows a strict statutory framework; no shortcuts, no flexibility, and no room for personal wishes. Think of it as a queue system where only certain people are allowed to stand in line.

Let’s walk through it.

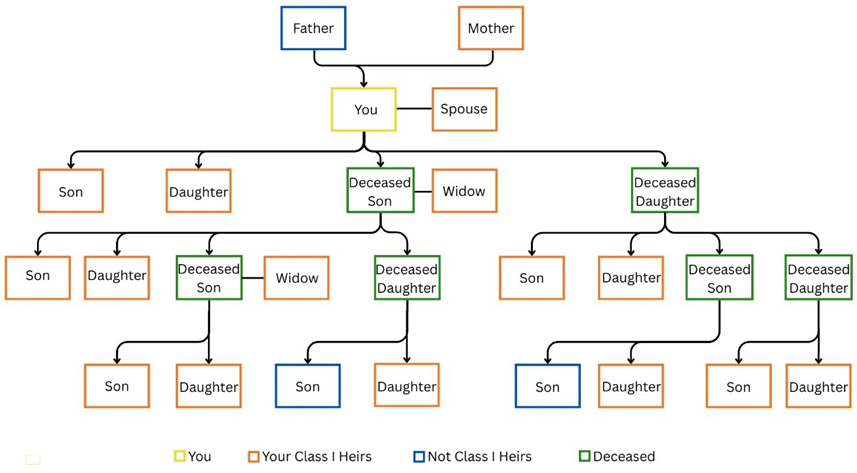

First in Line: Class I Heirs

This is the law’s priority list.

In the case of Hindu males, if the deceased leaves behind:

- A wife

- Children (sons or daughters)

- Mother (Only if no widow or children)

- Or children of a predeceased child

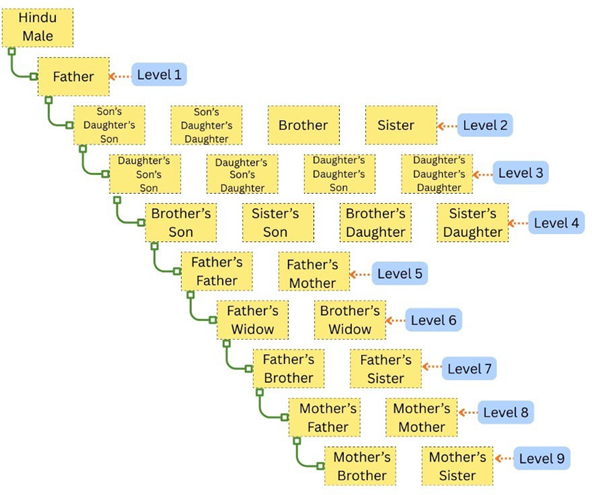

A flow chart simplifying this is provided below:

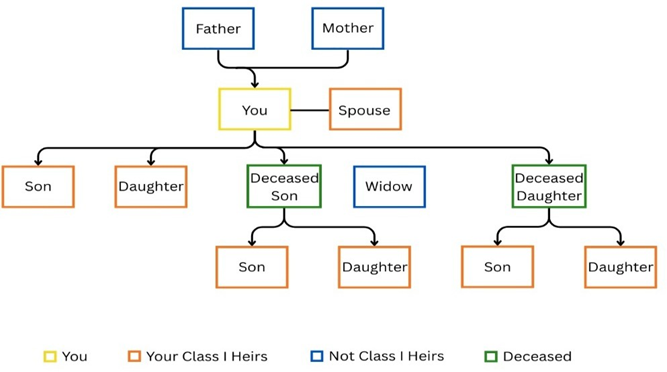

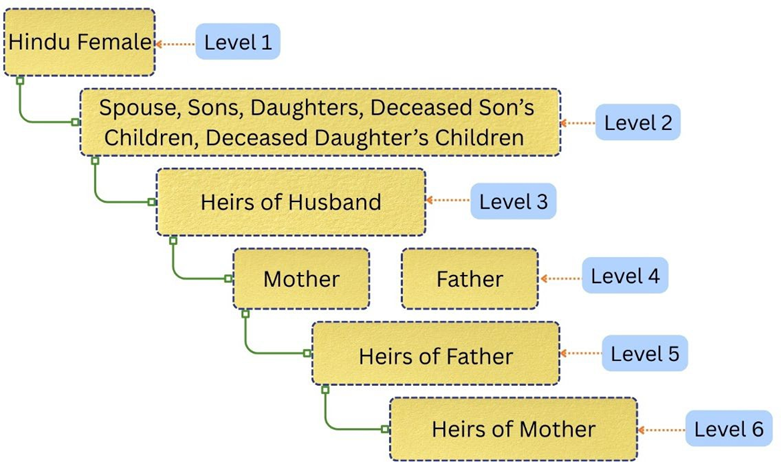

In the case of Hindu females, if the deceased leaves behind:

- A husband

- Children (sons or daughters)

- Or children of a predeceased child

They all inherit simultaneously and equally.

A flowchart simplifying this is provided below:

Here’s the key point people often miss:

If even one Class I heir exists, the process stops right here.

Parents, siblings, cousins and everyone else are automatically legally excluded, no matter how close the relationship was.

No Class I Heirs? Please proceed to the next group – Class II Heirs.

Next in Line: Class II Heirs

If there are no Class I heirs, the property passes to Class II heirs.

In the case of Hindu males, this group includes relatives and exclusions in Class I heirs such as:

- Father

- Brothers and sisters

- Grandparents and other specified relations

In the case of Hindu females, this group includes relatives and exclusion in Class I heirs such as:

- Father

- Brothers and sisters

- And other specified relations

Class II heirs are further divided into categories, and inheritance flows category-wise, not collectively. The presence of an heir in an earlier category completely blocks all subsequent categories.

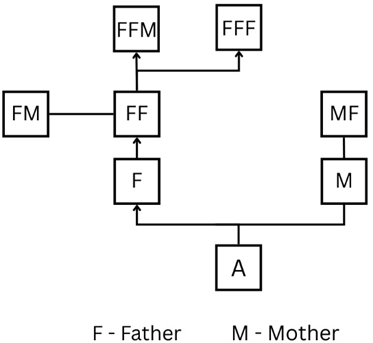

Next in Line – Beyond Immediate Family i.e. Agnates

If no Class I or Class II heirs exist, the law looks to agnates—relatives connected wholly through the male lineage.

One person is said to be ‘agnate’ of the other if the two are related by blood or adoption wholly through males. The agnatic relation may be male or female.

Examples include:

- Paternal uncles

- Sons of paternal uncles

- Other male-line relatives

Examples exclude:

- Mother (Connection is through female)

- Maternal Grandfather (Connection is via mother i.e. via a female)

Here, the principle of proximity applies: the closest agnate inherits first.

After That: Cognates

If there are no agnates either, the law looks at cognates, which are relatives connected through female links, either wholly or partly.

These could include:

- Maternal relatives

- Relatives linked through daughters or sisters

Again, proximity decides who inherits first.

The Last Outcome: Escheat to the Government

Here’s the part that surprises most people.

If no legal heir exists at any level, the property doesn’t stay “unclaimed” forever.

It escheats to the government.

Yes, without a will and without heirs, everything you built can legally end up with the State. This is not uncommon in cases where no succession planning has been done and family lines are unclear or extinguished.

Why This Matters More Than You Think

The Hindu Succession Act doesn’t ask:

- Who you were closest to

- Who took care of you

- Who you wanted to inherit

It only asks one thing:

Where does this person fall in the legal hierarchy?

This is precisely why estate planning and wills are essential and not optional. A will ensures that your assets go where you intend, rather than where the law defaults.

Because when no will exists, the law doesn’t ask for opinions; it simply follows its script.