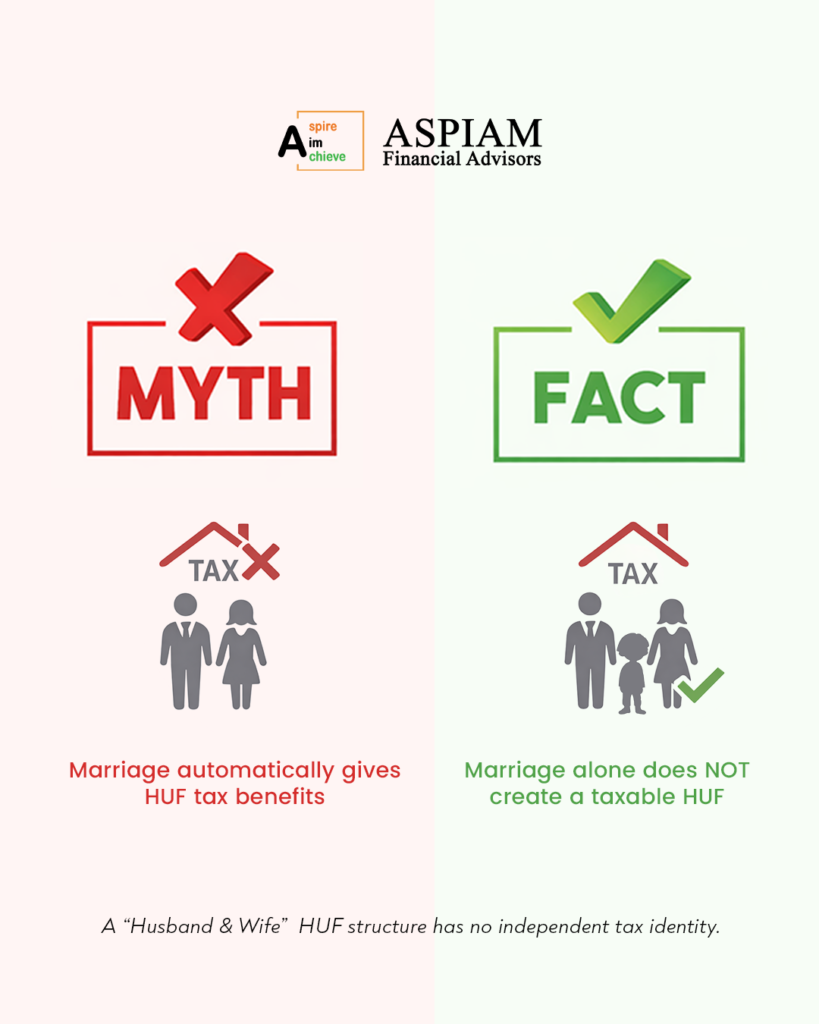

Getting married and forming a HUF does not automatically grant tax benefits. The law looks beyond intent and benefits, to one decisive factor: the existence of a coparcenary by birth.

Recognition of HUF and Requirement of Coparcenary for Tax Purposes

1. Statutory Basis

Section 2(31) of the Income Tax Act, 1961 recognizes a Hindu Undivided Family (HUF) as a “person” for assessment purposes. However, the Act does not define what constitutes a HUF or prescribe the conditions for its formation. The existence and composition of a HUF are determined under Hindu personal law (Mitakshara or Dayabhaga).

2. Hindu Law Foundation

Under Mitakshara law, a coparcenary arises when there are at least two coparceners having joint ownership rights by birth. Before the Hindu Succession (Amendment) Act, 2005, only sons were recognized as coparceners. After the amendment, daughters also became coparceners by birth with the same rights and liabilities as sons.

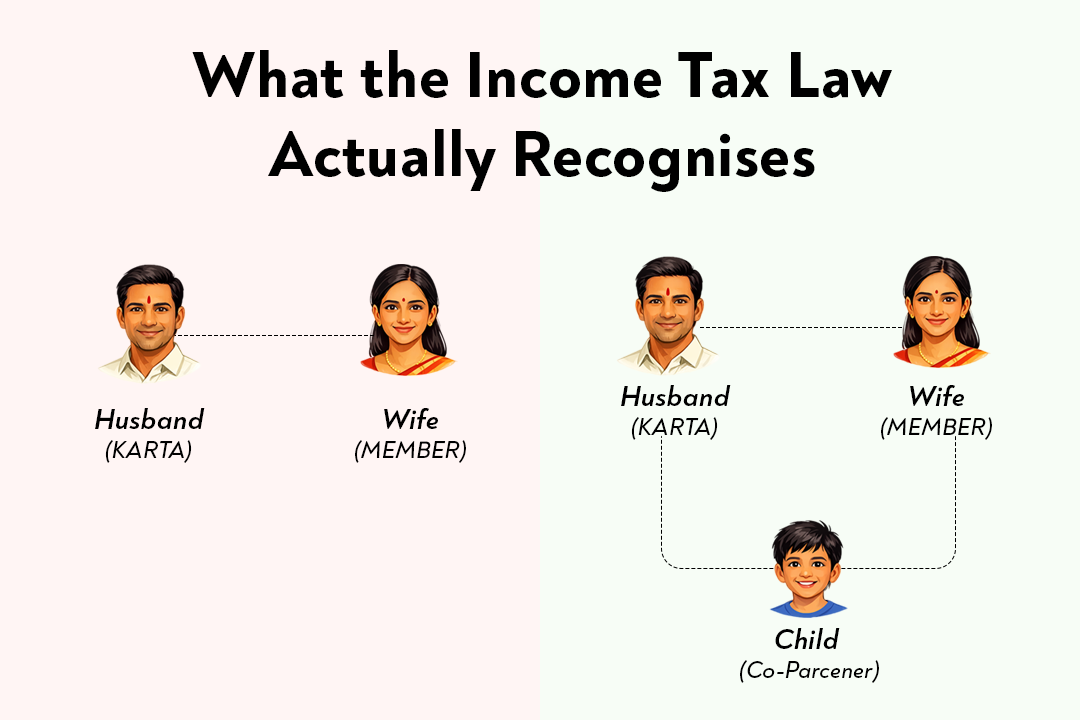

Accordingly, a HUF becomes a valid coparcenary when there are two or more coparceners—for example, a father and child (son or daughter).

3. CBDT Circular Reference

CBDT Circular No. 281 dated 22 September 1980 clarifies that a HUF comes into existence upon marriage but would have no coparcenary property until a child capable of having a joint interest is born or ancestral property is inherited. With the 2005 legal amendments, the principle extends equally to daughters.

4. Judicial Precedents Supporting the Principle

| Case | Citation | Key Principle Established |

|---|---|---|

| Surjit Lal Chhabda v. CIT | (1975) 101 ITR 776 (SC) | Husband and wife do not form a coparcenary; income from self-acquired property remains individual income. |

| Kalyan Singh v. CIT | (1982) 136 ITR 758 (All.) | HUF recognized for taxation only when at least two coparceners exist; merely husband and wife is insufficient. |

| CIT v. Ghanshamdas Mukim | (1979) 118 ITR 930 (Del.) | Separate HUF assessability arises when property is jointly held by coparceners. |

| Gowli Buddanna v. CIT | (1966) 60 ITR 293 (SC) | HUF is a taxable unit derived from Hindu law; coparcenary is essential for HUF recognition. |

| N.V. Narendranath v. CWT | (1969) 74 ITR 190 (SC) | Coparcenary property presupposes at least two coparceners; a single individual cannot form HUF with divisible interest. |

| C. Krishna Prasad v. CIT | (1974) 97 ITR 493 (SC) | Return filed as HUF is invalid if there is only one male member; coparcenary is essential. |

| Vineeta Sharma v. Rakesh Sharma | (2020) 9 SCC 1 (SC) | Daughters are coparceners by birth with equal rights and obligations as sons; coparcenary can exist with either. |

5. Practical Implication

- A husband–wife combination without children cannot constitute a coparcenary; any income claimed as HUF income would be taxed as individual income.

- Once a child (son or daughter) is born, coparcenary arises by operation of law, enabling recognition as a distinct taxable unit.

- Income or property inherited from an ancestral HUF can be assessed separately if evidence of coparcenary ownership is established.

The key message is straightforward: a HUF is not a structure that can be created at will for tax purposes. A husband and wife, without more, do not constitute a coparcenary, and any income claimed as HUF income in such cases risks being taxed in the individual’s hands. Only when coparceners exist—through birth, inheritance, or operation of law—does a HUF acquire a distinct and sustainable tax identity. Ultimately, recognising that a valid HUF flows from the existence of a coparcenary (i.e. Karta and coparceners) not from marriage or intent, forms the cornerstone of legally sustainable HUF taxation.